Digital wallets have become one of the most popular options for making mobile payments today, and two of the main competitors are Google Pay and Samsung Pay. Both offer a fast, secure and convenient way to pay in stores, but which is the best option for you?

Both offer a contactless payment experience using NFC (Near Field Communication) technology to make transactions in physical stores, and depending on your preferences, you may wonder what the difference is between the two and which one is actually the best option.

Although the answer seems simple, it is important to know the benefits of each in order to make the best decision for your needs. We will tell you in detail below.

What are Google Pay and Samsung Pay and how do they work?

Before you can highlight the differences between both platforms and see which one is best for you, you need to know what each one is and how it works. Although they may be similar, they are not the same.

Samsung Pay is a digital wallet and mobile payment where you can easily and conveniently manage debit cards, credit cards, gift cards and memberships from any compatible smartphone such as smartphones, tablets or smartwatches.

This platform is perfect for paying online transactions in stores and with other users through physical contact, compatibility with devices that support NFC, or online stores or applications.

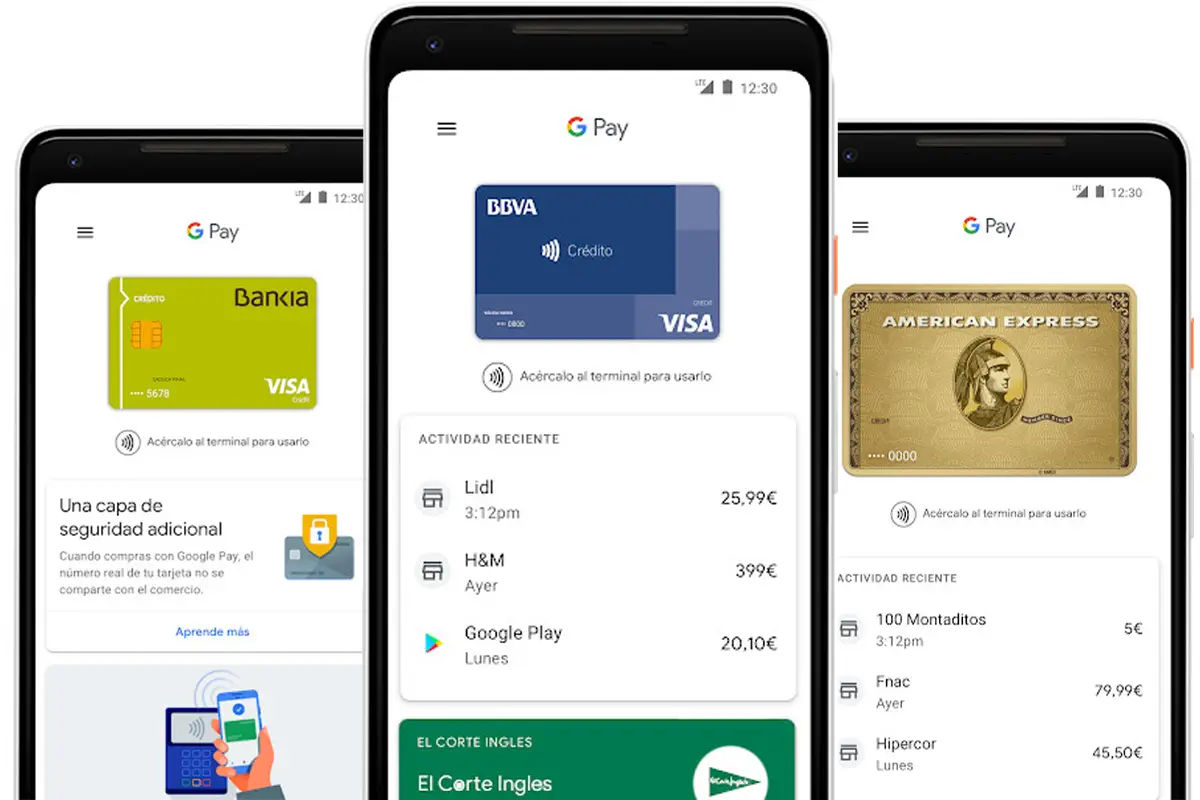

Google Pay, on the other hand, is a digital and mobile payment wallet where you can manage debit cards, credit cards, gift cards and memberships. It is also compatible with smart devices such as smartphones, tablets or smart watches using NFC technology.

Differences between Google Pay and Samsung Pay

Now, at this point you’re probably wondering: What’s the difference between the two? They are similar platforms; They allow you to perform the same actions, both are safe, secure and offer great versatility. However, there are four key things to distinguish them, which we will mention below.

Device compatibility

One of the main differences between both services is the compatibility of smart devices. On the one hand, Samsung Pay is only compatible with Galaxy devices, meaning you need to have a Samsung phone, tablet or smartwatch to use it.

However, Google Pay is more open than the Asian option. That means you can use it on any Android device or iPhone. Of course, for iOS users there is a limit on the touch payment function due to the restrictions of the American manufacturer.

Security

If there is one thing that both digital wallets boast of, it has an excellent security network that protects their users’ data from any theft attempt or data loss and virtualization, albeit with different mechanisms.

If we talk about Google Pay, the main point to emphasize in relation to security is that by replacing your real card number with a personalized digital card number, your data will be completely hidden from any company, so it will not be for them. It is tracked or stored for additional protection.

Samsung Pay also offers two unique security systems: Samsung Knox, Samsung’s own security platform, and support for MST (Magnetic Secure Transmission) technology for making payments.

To give you a better idea, we’re talking about mobile payment technology that uses magnetic waves to transmit data from a device to a card reader, simulating a physical swiping motion.

Bank availability

Both platforms lead to wide accessibility and compatibility with banking entities and financial instruments, giving you great convenience and versatility in managing your payments.

Google Pay is supported by hundreds of banking entities and payment providers, as well as compatibility with major debit and credit cards worldwide. Among the banks in Spain are Banco Santander, BBVA, Caja Rural, ING, Cajasur and others.

As for Samsung Pay, its banking offerings are smaller, though equally diverse. Similarly, it supports major debit and credit cards such as Visa, MasterCard, AMEX and others. In relation to banks in Spain we find CaixaBank, Bankinter, Banco Santander and BBVA to name a few.

Benefits

Discounts and rebates are great attractions for any user when deciding which platform to use. Fortunately, both Google Pay and Samsung Pay offer great benefits as well as very interesting rewards and loyalty systems.

Google Pay has a very eye-catching idea with its Cash Back Awards system and cash gift cards for online stores, apps and more.

Although Samsung Pay offers a reward system with a very similar mechanism, the Asian manufacturer offers Samsung Rewards, where you can accumulate points with each transaction and redeem them in the Galaxy Store or on the official website for the purchase of Samsung products. Brand name.

Which is better, Google Pay or Samsung Pay?

As you can see, choosing one or another service depends mainly on your needs and the mobile device you use. Either way, both options are great when it comes to managing your payments and money digitally.

Now that you know how each of them works, their differences and benefits, tell us which one is right for you and why. We read in the comments.

If you liked this article, don’t forget to check out all the benefits Google Pay has to offer, or better yet, take a deeper dive into how Samsung Pay works.